Automotive

Building automobiles of the future: Localization of EV supply chain in India

14 Aug 2020

India is the 4th largest passenger vehicle market

after China, USA and Japan. It is also the largest 2W and 3W market. Therefore,

India will play a pivotal role in the quest for EVs in the changing global

order. The opportunity to drive EV adoption will provide immense opportunities

for EV companies and component manufacturers in India.

Change in policies and

push for localization

Indian Government has created momentum for EVs

through its INR 10K Cr FAME Faster Adoption and Manufacturing of (Hybrid &)

Electric Vehicles Scheme. Under FAME-I, the Government aimed to make EVs

attractive largely by providing direct subsidies to customers and providing tax

cuts and reducing import duties for manufacturers, but it has tweaked the

policy under FAME-II where the emphasis has shifted towards building a robust

indigenous EV ecosystem.

FAME-II scheme placed additional restrictions

on EVs to be eligible for subsidies. OEMs now have to ensure at least 40%

localization (at ex-factory prices) for buses and 50% localization for other

categories. Benefits were discontinued for lead-acid batteries and were limited

to Li-ion batteries. Additionally, import duties on Completely Built Units (CBUs),

Semi Knocked Downs (SKDs), and Completely Knocked Downs (CKDs) were increased

by 5% to 25% w.e.f. April 2020. On the other hand, duties on Li-ion cells and

battery packs are set to increase from 5% currently to 10% and 15%. It will be

prudent to provide large scale incentives to develop giga-factories in India

before moving to a high tax regime on Li-ion cells, so India can develop the

required ecosystem to manufacture them.

Under the Phased Manufacturing Program (PMP)

which falls under FAME-II, the Government has already mandated indigenization

parts like HVAC (Heating, Ventilation, and Air Cooling), wheel rim integrated

with hub motor from October 2019 and other key components such as electronic

throttle, vehicle control unit, electric compressor, etc. by October 2021.

Several states in India are racing to attract

investments from OEMs and components players to emerge as an EV manufacturing

hub. Incentives range from setting up EV manufacturing parks, providing aid for

R&D and IP, partial or full reimbursements on land costs, financial

assistance on capital incentives, etc.

Opportunities and

challenges in EV localization

India’s vision to emerge as a major manufacturing hub for EVs

represents huge opportunities for the auto sector. While historically India has

been very good at cost engineering, there are challenges to be overcome to

realize this vision. Current levels of localization

in the Indian EV sector are as low as 20%

which has been limited due to the cost competitiveness of foreign providers,

deep technological expertise involved as well as limited access to crucial raw

materials such as lithium and rare earth magnets.

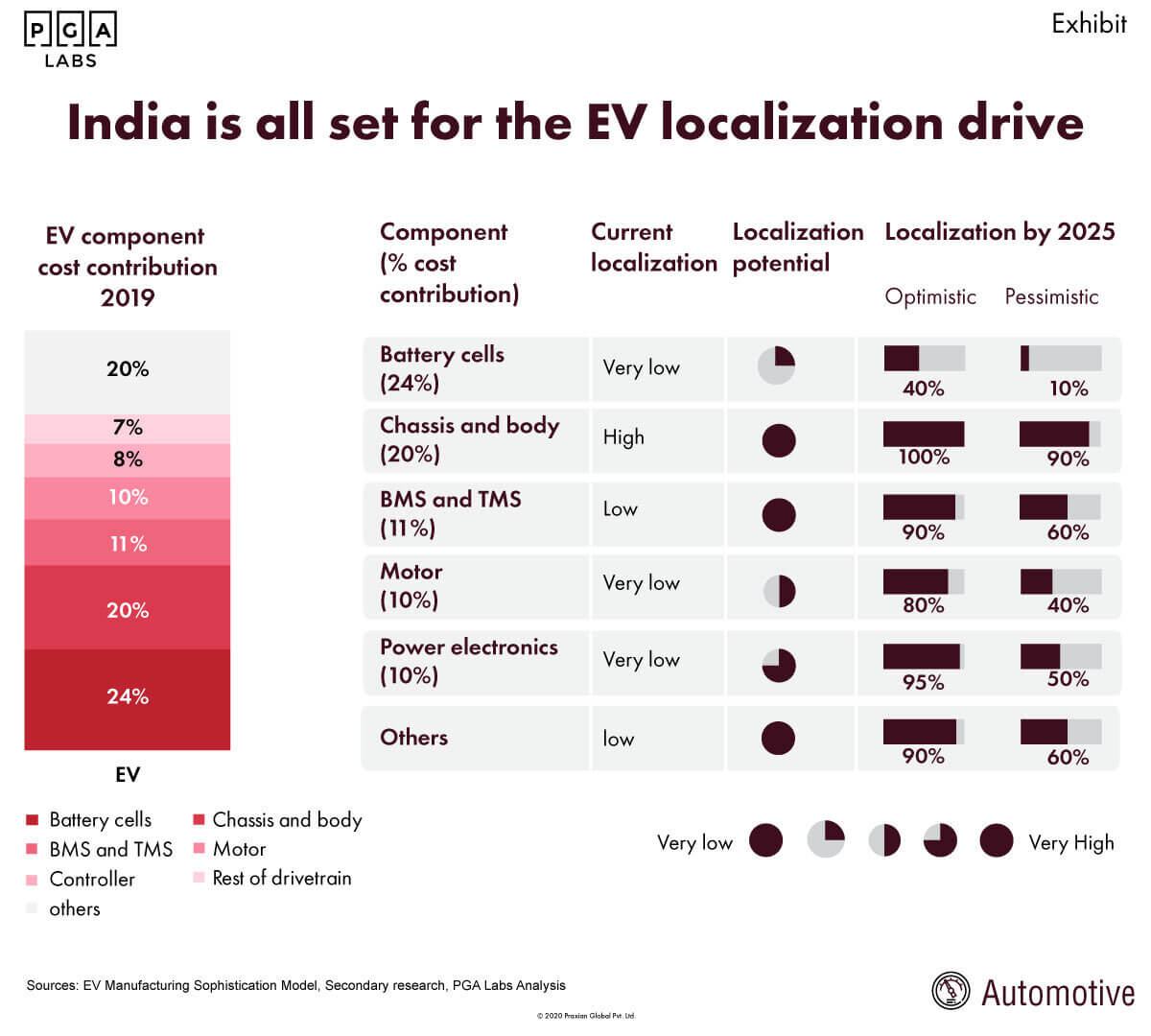

EV manufacturing requires deeper technological expertise than

ICE automobiles. In terms of cost, the battery is the most intensive component

of an EV contributing around 24% - 28% while BMS and TMS (Battery / Thermal

Management Systems) contribute an additional 10% - 14%. Other specialized parts

such as motors (10%), controllers (8%), and rest of drivetrain (7%) contribute

25% of the overall cost. The extent of localization going forward is not

expected to be uniform across components due to specific challenges in terms of

technology, raw materials, and the scale required to justify localization.

Several large players have invested US$ 1.5B in total

during 2019 - 2020 to set Li-ion battery manufacturing plants. Most

investments are concentrated in the state of Gujarat followed by Andhra Pradesh

and Telangana. However, widespread indigenization of Li-ion battery production

is unlikely in the medium to long term. Li-ion battery imports tripled from US$

348M in FY17 to US$ 1.2B in FY19, 85% of which was from China followed by

9% from Vietnam. We did detailed modeling of value chain localization based

on our EV Manufacturing Sophistication Model. By FY25, we estimate the

localization of Li-ion batteries in EVs to be 40% in the optimistic scenario

and 10% in the pessimistic scenario.

The above

exhibit shows that the contribution of batteries to EV cost is the largest.

Also, the potential for localization of chassis and bodies and BMS is high while

localization of specialized components such as batteries and motors could be

limited. Reasons for the current battery localization scenario include:

- Battery cells (24%): Lack of access to core raw materials like lithium and technology-intensive manufacturing to limit localization. Govt. needs to incentivize companies to acquire overseas Lithium mines

- Chassis and body (20%): These parts do not require special raw materials or technology and are already produced locally

- BMS and TMS (11%): Battery Management System technology is mostly software system driven and can be mastered locally

- Motor (10%): Lack of availability to rare earth magnets is a major hurdle. Large motors could take longer to localize

- Power electronics (10%): Power electronics like controllers and power IC are technology-intensive; capital investment necessary

- Others: Indian manufacturers are strongly positioned in this category which includes HVAC, control units, etc.

There are several major challenges to domestic Li-ion battery

production. Firstly, battery technology is currently evolving at a rapid pace

with new chemistries gaining popularity. The associated R&D is technologically intensive. Although the Indian Space

Research Organisation (ISRO) has transferred Li-ion battery technology to 10

firms that have set up plants in the country, India has not been at the

forefront of the innovations in battery technology.

The second major challenge is the unavailability of core raw material in the manufacturing of Li-ion

batteries, i.e. Lithium metal. India currently imports all its Lithium needs.

There is not comprehensive estimate available for Lithium reserves in India. In

Feb 2020, researchers at the Atomic Minerals Directorate, a unit of India’s

energy commission discovered around 14K tonnes of lithium reserves near Bengaluru

which is still very small compared to the leading countries. Chile has around

8.6M tonnes, Australia has 2.8M tonnes, Argentina has 1.7M tonnes and China has

1M tonnes of lithium reserves. In terms of production, Australia is the leader

with a production of 51K tonnes per year followed by Chile at 16K tonnes and

China at 8K tonnes.

The third major challenge is the cost competitiveness of Chinese Li-ion batteries. As in the case of

solar panels, China has ensured the global domination of Li-ion batteries.

China is home to 73% of the total installed capacity of Li-ion batteries

followed by the US far behind at 12%. Given the uncertainty around the exact

scale of EV adoption in India, large scale indigenization of batteries is

expected to take more time especially in case of large batteries (Passenger

vehicles, Commercial vehicles, buses, etc.).

The localization in

BMS and TMS can be high as they can be mastered in India relatively easily.

India is one of the leading exporters of software technology in the world.

According to RBI data, India’s software exports increased by 11.6% YoY and

amounted to US$ 108B in 2018. Field experience is critical for fine-tuning BMS

and that will come with a learning curve of the market, enhanced by sharing of

data from global leaders in the BMS space.

The unavailability of

rare earth magnets such as the Neodymium magnet which is the most widely

used in the production of motors for an electric vehicle is the key bottleneck

for the domestic EV motor industry. China is the leading producer of rare earth

magnets accounting for over 90% production and over 40% reserves. Small motors

for light electric vehicles would be relatively easier to manufacture locally,

but large motors need sophisticated technologies and could take longer to

localize. There have been advances in the field to reduce dependence on rare

earth magnets which can increase localization. E.g. Fraunhofer, a German

research organization discovered ways to reduce dependence on rare earth

magnets by up to 80%, however, the methods were not economical to scale. In

2018, Toyota managed to cut dependence on rare earth magnets by 20% in their

EVs. Localization of EV motors can reach up to 70% in the optimistic scenario

by FY25.

Power electronics,which include controllers, power IC's, etc. can be localized but are technology-intensive and would require investments in technology to be produced locally. There are already companies focusing on EV controllers, especially for the 2W and 3W markets where the incumbents are not strong, and a large opportunity exists. Global players are more focussed on PV and CV segments.

The winners in the EV supply chain will act decisively and fast to

make the automobiles of the future. To leverage India’s cost advantage and

achieve the desired high levels of localization of EV manufacturing in India,

ecosystem stakeholders need to start with the following:

- Commitment and investments in technology from incumbent OEMs and auto component companies

- Extensive focus on R&D would have to be facilitated to find alternatives and reduce dependence on scarce natural resources required for EV manufacturing

- Policymakers will have to strike a balance between promoting localization while making EVs economical & scaling charging infra to drive adoption and unlock economies of scale

Authored by:

Sanjeev Garg, Practice

Leader, Automotive

Aryaman Tandon,

Practice Director, Automotive